The New Jersey governor pledges to “tell it like it is,” but his fiscal record and rhetoric don’t line up.

Now that Chris Christie is officially running for president, his record as governor of New Jersey will be getting a lot more scrutiny. As we reported with The Washington Post in April, there’s plenty to look at.

Our reporting focused on Republican Christie’s fiscal record, an area where he’s claimed some of his biggest achievements – and committed some of the “Budget Sins” he attacked his predecessors for.

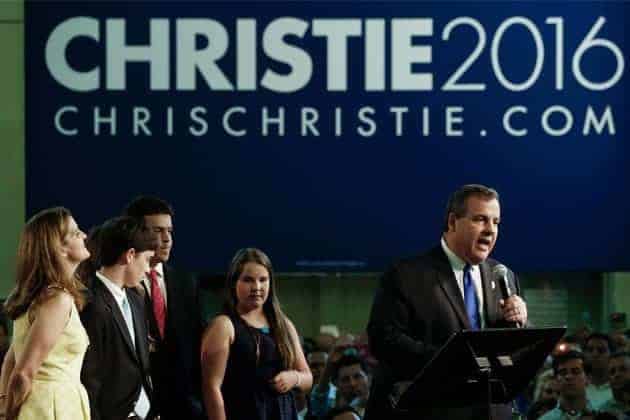

Kicking off his campaign today, Christie used familiar rhetoric to champion his record in New Jersey. “We rolled up our sleeves and we went to work and we balanced six budgets in a row,” he said. “We’ve refused to raise taxes on the people of this state for six years.”But as our earlier reporting showed, Christie’s fiscal record doesn’t always line up with his campaign’s “Telling It Like It Is” tagline. Take public employee pensions, a chronic problem in New Jersey.

When Christie signed his sixth budget on Friday, he reiterated his claim that his contributions to the state’s pensions have far outpaced those of his predecessors. As we pointed out in April, that’s only true if you exclude a $2.75 billion pension contribution by former Republican Gov. Christine Todd Whitman.

Christie doesn’t count Whitman’s payment because it was made with borrowed money, allowing him to assert that pension contributions under his administration are “more than twice as much as any other governor in New Jersey history.”

More recently, Christie has also claimed a pension victory from a New Jersey Supreme Court decision that came out in his favor. But again, the circumstances are more complicated than he describes.

“We just won a major court decision supporting the pension reforms that we put into place in 2011,” Christie told ABC’s George Stephanopoulos during a recent interview on “This Week.”

The details: The court ruling actually allowed Christie to avoid making a full $2.25 billion payment to the pension funds due by today, as dictated by the reforms. To allow for a smaller contribution – $893 million – Christie’s lawyers had argued that a key provision of the reforms was unconstitutional.

In the past, Christie has claimed the pension reforms as one of his biggest political wins.

Entangled in the recent pension wrangling was another issue we reported on in April – a reduction in the state’s Earned Income Tax Credit under Christie. The cut effectively raised taxes on the working poor.

New Jersey Democrats, who control the legislature, had pushed a “millionaires’ tax” to help make the full pension contribution in the state’s 2016 fiscal year. Christie vetoed the tax – and then sent a surprise proposal back to lawmakers to restore the prior cut in the tax credit and raise it even higher.

But the proposal came with a catch – it required concurrence with the millionaires’ tax veto. Democrats groused that it would give Christie a campaign sound bite, but they went along anyway. The tax credit increase now awaits Christie’s signature.