The U.S. Department of Education announced today a new process to identify and assist federal student loan borrowers who may be eligible for Total and Permanent Disability (TPD) loan discharge. This effort was called for by President Obama in his Student Aid Bill of Rights, which details measures to make paying for higher education an easier and fairer experience for millions of Americans. The Higher Education Act allows for loan forgiveness for borrowers who are totally and permanently disabled. By identifying and contacting borrowers who may be eligible for TPD loan discharge, the Department is ensuring that disabled borrowers have the information needed to take full advantage of the debt relief program.

“In 2012, the Administration took steps to streamline the process to allow for Americans who are totally and permanently disabled to use their Social Security designation to apply to have their loans discharged. But too many eligible borrowers were falling through the cracks, unaware they were eligible for relief. Borrowers like one such woman whose side effects from her breast cancer treatment left her totally and permanently disabled. After repeated attempts, she finally received a disability discharge—seven years after her first application,” said U.S. Education Under Secretary Ted Mitchell. “Under the new process, we will notify potentially eligible borrowers about the benefit and guide them through steps needed to discharge their loans, helping thousands of borrowers. Americans with disabilities have a right to student loan relief. And we need to make it easier, not harder, for them to receive the benefits they are due.”

Background

Through the Treasury Offset Program (TOP), borrowers’ defaulted debts owed to federal and state governments, including student loan debt, are paid down by offsetting other federal benefits that the debtor would receive, including Social Security Disability payments.

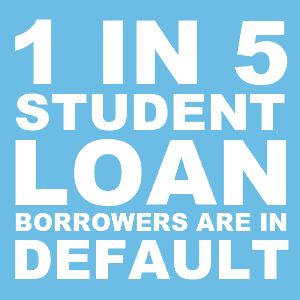

The Department of Education has been working closely with the Social Security Administration (SSA) to complete a data match to identify federal student loan borrowers who also receive disability payments and have the specific designation of “Medical Improvement Not Expected” (MINE) which, because of a change in Department regulations in 2013, qualifies them for loan forgiveness under the TPD discharge program. This streamlined and more accurate process ensures that eligible borrowers receive loan discharges. Approximately 387,000 borrowers were positively identified in the first set of matches which were conducted in December 2015 and March 2016. In total, these borrowers have a combined loan balance of over $7.7 billion, and roughly 179,000 are currently in default. As required by federal law, over 100,000 of those borrowers with defaulted loans have been certified for the TOP, and are therefore at risk of losing federal tax refunds, and of having their Social Security benefits offset. Today’s announcement will ease the process of obtaining forgiveness for these struggling borrowers and ensure they receive this entitlement under the law.

Beginning on April 18, 2016, borrowers who were positively identified in the match will receive a customized letter explaining that the borrower is eligible for loan forgiveness and the simple steps needed to receive a discharge. Unlike other borrowers, those identified through the data match will not be required to submit documentation of their eligibility. Instead, they are eligible for a streamlined process by which they simply sign and return the completed application. Initial notification letters will be sent over a sixteen-week period and will be followed up with a second letter that will be sent 120 days after the initial letter if a signed application is not received. Notification will also include information to ensure borrowers understand the potential tax implications for this benefit and can make an informed decision about electing a discharge. Please refer here for more information about the TPD program and the loan forgiveness process for practitioners. We ask that this be shared with appropriate networks to reach the borrowers that this process aims to serve.

While the President’s 2017 Budget proposal seeks to exclude TPD discharges and other Department of Education loan forgiveness programs from taxable income, unless Congress acts, loans discharged under the TPD program may be subject to taxation, depending on the specific circumstances of the borrower.

Going forward, this match will be conducted quarterly to ensure that newly eligible borrowers are aware of their options.

Increased safeguards to protect student loan borrowers

The Department has implemented a number of other measures outlined in President Obama’s Student Aid Bill of Rights to help student borrowers struggling to repay their loans.

Last year, the Department, in consultation with the Department of the Treasury and the Consumer Financial Protection Bureau (CFPB), developed a report on how all responsible parties could increase borrower protections in the federal student loan program and strengthen student loan servicing, among other efforts. Key statutory recommendations include:

Update Debt Collection and Offset: Index to inflation the amount of Social Security benefits exempt from offset, consistent with the proposal in the President’s 2017 Budget applicable to student loans and other debt owed to the federal government

Enhance Federal Data-Sharing to Improve the Federal Student Loan Borrower Experience: Streamline the process for those who are eligible to have their loans discharged because of a disability

Increase borrower protections in the federal student loan program: Eliminate the tax liability for student loan discharges, including those related to Income Based Repayment and Income Contingent Repayment

Borrowers are encouraged to visit https://disabilitydischarge.com for more information.